Cannabis Regulations

***Applications for a use permit and operation permit to conduct a commercial cannabis activity can be found below under "supporting documents".***

Overview

In November 2016, Proposition 64 (the Adult Use of Marijuana Act or “AUMA”) passed in all precincts of Mono County, and the majority of California. The State has established emergency regulations and annual applications for commercial cannabis activity.

In January 2017 the County extended an adopted moratorium prohibiting cannabis-related business from occurring on all lands until December 2018 while the supervisors develop permanent rules.

Since that time, Community Development staff has led outreach via community meetings to gauge residents’ concerns and desires for regulation. General Plan Policies governing commercial cannabis activities have also been accepted (Board of Supervisor meeting 12.5.2017; GPA 17-03). The General Plan Amendment 18-01, including Chapter 13 - Commercial Cannabis Activities, was approved by the Board of Supervisors (4.17.2018); and County Code Chapter 5.60 - Cannabis Operations was approved by the Board of Supervisors (5.1.2018). Please see the Supporting Documents below.

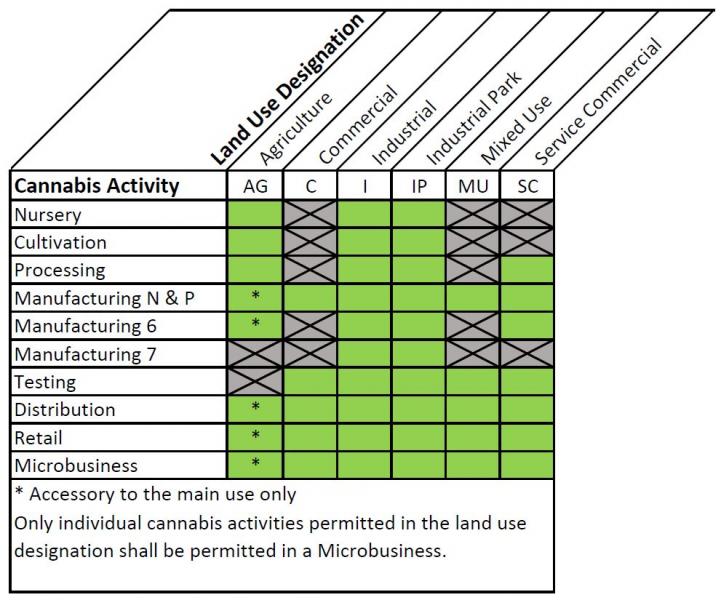

The General Plan Amendment amended Countywide policies and actions, and the land use designations' "Uses Permitted Subject to Use Permit". The following chart displays which cannabis activities may take place in Mono County land use designations.

Please also note, regardless of land use designation, a cannabis business may not locate within 600' of any of the following facilities existing at the time of the application: schools providing instruction to kindergarten or any grades 1 through 12, day care center or youth center, parks, ball fields, playgrounds, libraries, community centers, and licensed child care faculties (Land Use Element, Countywide Policies, Action 1.L.3.a.).

UPCOMING MEETINGS

If you wish to receive email updates about the County’s regulation process please contact Michael Draper, (760) 924-1805 or mdraper@mono.ca.gov.

For information from past meeting discussions on cannabis, please visit the following page: https://monocounty.ca.gov/meetings

Commercial Cannabis Tax measure

Mono County has approved a Cannabis Business Tax Measures to be placed on the June 5, 2018 ballot. For more information please visit: https://monocounty.ca.gov/cao/page/mono-countys-cannabis-business-tax-me...

Proposition 64 makes the following changes to California law:

Effective November 9, 2016:

- Adults over the age of 21 may legally use cannabis provided it is not in public areas/view.

- Adults over the age of 21 may possess, transport, obtain, or give away to other adults (21 or older) one ounce of marijuana or 8 grams of concentrated cannabis.

- Adults over the age of 21 may cultivate up to six plants per private residence, indoors and in a secure location, and possess marijuana produced by these plants.

*Note: Counties may ban outdoor cultivation, but must allow cultivation in a private residence or other structure on the property.

Effective January 1, 2018 cannabis excise taxes and cultivation taxes go into effect - a production tax of $9.25/ ounce of flowers plus an additional 15% excise tax on retail sales of marijuana both adult-use and medical

**Commercial sale, cultivation, and production of marijuana are allowed only by State and Local licensed providers.

State Live Scan Request forms:

Cultivation: https://www.cdfa.ca.gov/calcannabis/documents/LivescanApplication-8016-A...

Manufacturing: https://www.cdph.ca.gov/Programs/CEH/DFDCS/MCSB/CDPH%20Document%20Librar...

Retail: The ‘Request for Live Scan’ form will be sent to the applicant via email or mail once the annual application has been submitted to the Bureau.