Prop 19 Information

About Proposition 19

In November 2020, California voters passed Proposition 19 , which makes changes to property tax benefits for families, seniors, severely disabled persons, and victims of natural disaster in our state.

Disclaimer: The information provided is intended to provide general and summary information about Proposition 19. It is not intended to be a legal interpretation or official guidance, or relied upon for any purpose, but is instead a presentation of summary information. Proposition 19 is a constitutional amendment, so additional legislation, regulations, and statewide guidance are expected to clarify its implementation. If there is a conflict between the information provided here and the proposition or any legal authorities implementing or interpreting the proposition, the text of the proposition and the other implementing or interpretive authorities will prevail. Please continue to visit our website or the website of the State Board of Equalization for more information. We encourage you to consult an attorney for advice on your specific situation.

More Information - California State Board of Equalization Prop 19 Info Page >>

What is Proposition 19?

On November 3, 2020, California voters approved Proposition 19, the Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act. Proposition 19 is constitutional amendment that limits people who inherit family properties from keeping the low property tax base unless they use the home as their primary residence, but it also allows homeowners who are over 55 years of age, disabled, or victims of a wildfire or natural disaster to transfer their assessed value of their primary home to a newly purchased or newly constructed replacement primary residence up to three times.

The new law will make important changes to two existing statewide property tax saving programs:

- Replace Proposition 58(1986) and Proposition 193(1996) by limiting parent-and-child transfer and grandparent-to-grandchild transfer exclusions ( See current Prop. 58/193 here) - Effective 2/16/2021

- Replace Proposition 60(1986) and Proposition 90 (1988) programs for home transfer by seniors and severely disabled persons (See current Prop. 60/90 programs here) - Effective 4/1/2021

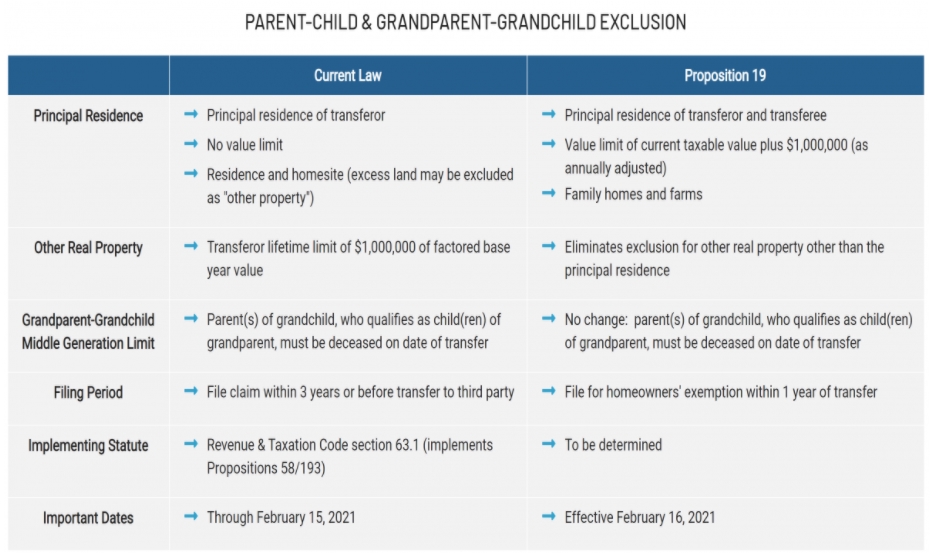

Changes to Parent-and-Child and Grandparent-to-Grandchild Transfer Exclusions (Effective February 16, 2021)

Current laws allow parents, grandparents and children to pass on the existing assessed values of their primary residence and other properties up to $1 million in assessed values without reassessment. However, under Proposition 19 these programs will be limited with fewer tax savings opportunities. See below for the chart developed by the State Board of Equalization to compare the current law and the effects of Proposition 19.

ALERT! If you plan to record a deed before Proposition 19 becomes effective on February 16, 2021, please note that February 15, 2021 is President’s Day, a legal holiday, and our Office is closed. We expect a high volume of document submissions during that time, any discrepancies or errors found in the process may require additional time to clarify or correct, which may cause further delay on the recording timeline. Early recording is highly recommended.

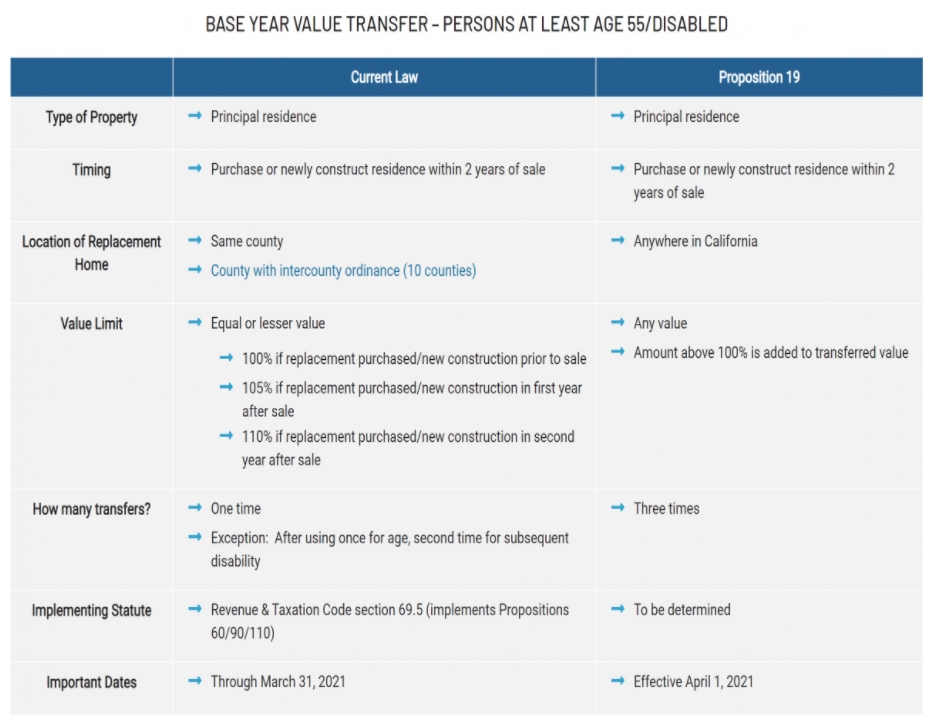

Changes to Senior Replacement Home Transfers (Effective Apri1 1, 2021)

Current laws allow seniors over 55 years old and severely disabled persons to transfer the taxable value of their existing home to their new replacement home, so long as the market value of the new home is equal to or less than the existing home's value. The program was also limited to once in a lifetime, with additional restrictions where the replacement home is located (usually within the same county or within some counties that allow for reciprocity). Proposition 19 will make these programs more flexible. See below for the chart developed by the State Board of Equalization to compare the current law and the effects of Proposition 19.